Tesserent Limited (ASX:TNT) shares rose over 10 per cent today, reaching a high of $0.325 following a quarterly cash report and business update of its activities and achievements for the quarter ended 30 June 2021.

Highlights

Financial Highlights

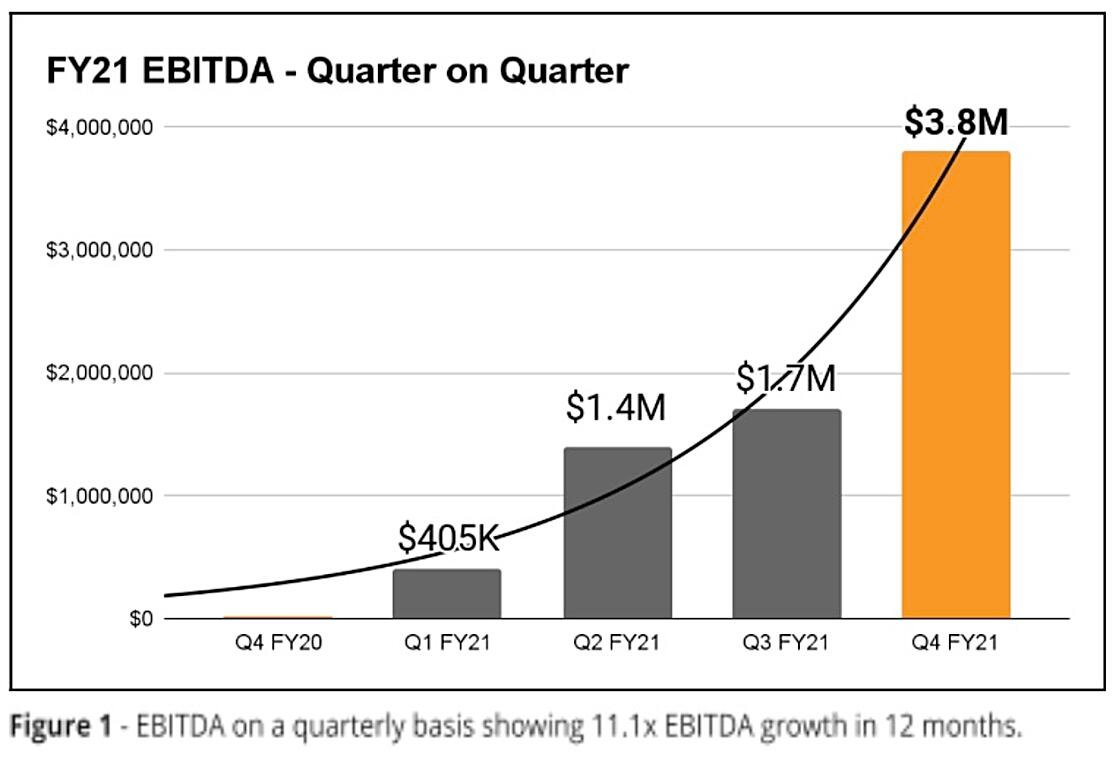

The company exceeded all set financial objectives for Q4 FY21 with record earnings, turnover and customer receipts growth.

The company continued to build its quarter on quarter operating profitability, increasing operational EBITDA to $3.8M for the quarter, up 125.5% from the previous quarter’s $1.7M. With $14.9M in available cash at the end of June, and with strong full year earnings performance expected to continue, the Company is in a healthy financial position heading into FY22.

Record quarterly turnover of $38.2M was achieved in Q4, with record monthly turnover of $20.8M achieved in the month of June. This helped generate record quarterly customer receipts of $33.5M, up 53% on Q3.

The company also announced record cash flow positivity for the June quarter, achieving $5.3M in positive cash flow from operations, a growth trend that the Company expects to continue for the foreseeable future.

STRONG BASE TO START THE NEW FINANCIAL YEAR

After achieving record growth, driven by strong seasonal financial year end sales, the company confirmed it is well placed to enter FY22 with a continuing focus on organic growth, cross-selling opportunities and strategic acquisitions where they add to the Company’s Cyber 360 vision.

The company completed the strategic acquisition of Secure Logic (April 2021), while Tesserent Innovation completed strategic investments into TrustGrid (June 2021) and AttackBound (June 2021) with a further investment into biometric security firm Daltrey completed in July 2021.

With the strategic investment into biometric security firm Daltrey, Tesserent Innovation has significantly expanded the company’s existing Converged Security offering with joint venture partner Optic Security across Australia and New Zealand.