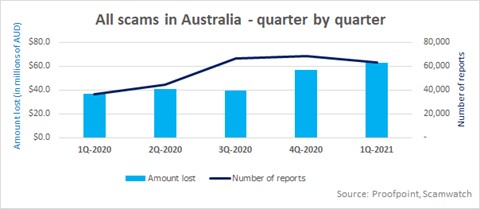

Australians lost a combined $63.1 million to all types of scams in Q1 2021, according to the latest figures from the Australian Competition & Consumer Commission’s (ACCC) Scamwatch. This represents a significant increase of 73% from the same three-month period in 2020. The total amount lost is also up 12% from the figures conveyed to Scamwatch in Q4 2020, despite a lower total number of scams reported.

| Quarter | Amount lost | Amount lost (millions of AUD) | YoY change | Number of reports | Reports with financial losses | YoY change |

| Q1 2020 | $36,560,127 | $36.6 | 73% | 36,199 | 42.50% | 74% |

| Q1 2021 | $63,186,174 | $63.1 | 62,900 | 28.4% | ||

| Quarter | Amount lost | Amount lost (millions of AUD) | QoQ change | Number of reports | Reports with financial losses | QoQ change |

| Q4 2020 | $56,647,599 | $57 | 12% | 68,795 | 26.50% | -9% |

| Q1 2021 | $63,186,174 | $63.1 | 62,900 | 28.4% |

Gender divide

In March 2021, men lost significantly more money to scams, accounting for 70.4% ($14.2 million) of the total money lost compared to just 29.5% ($5.9 million) for women. This trend was observed across the first quarter of the year, with men losing more money to scams (56.5% v 43.6%) compared to the previous year, which saw a higher proportion of money lost by women (56.8% v 43.2%). Men were also disproportionately impacted by investment scams, identify theft, and medical product scams in terms of money lost, while women lost more money to dating and romance and false billing scams.

Top types of scams reported

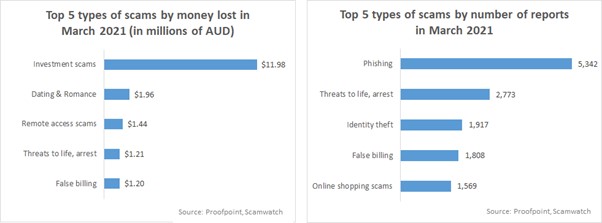

Across the quarter, investment scams were consistently the most damaging type of scam in dollar terms, costing Australians $30.1 million and accounting for nearly half of all money lost. These scams see cybercriminals posing as a broker or portfolio manager to get individuals to part way with their money in return for a financial investment opportunity such as purchasing shares, funds, leveraged products, cryptocurrency, or other high-return schemes. Dating and romance scams were the second largest source of money lost across the quarter, costing Australians nearly $12 million.

In terms of the number of scams reported, phishing scams were consistently the highest across the quarter, a trend that has endured for the last six months. These scams, which aim to steal personal information and credentials from individuals and organisations, accounted for 23% of all scams reported in Q1, a staggering increase of 169% compared to Q1 2020. Threats to life and arrest and identity theft scams also appeared in the top five reported scams across all months in the quarter.

As identified in February, scams relating to health and medical products continued to increase in March, likely associated with the COVID-19 vaccine roll out, with the total amount lost up more than 300%. Reports of ransomware were also up by nearly 50% compared to February, with the amount of money lost to ransomware scams experiencing an increase of more than 1100% compared to the same period in 2020.

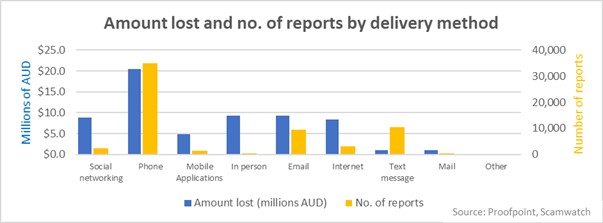

Delivery method

On average, scams delivered via phone calls were the most profitable across Q1, accounting to more than $20 million or 32% of total losses, an increase of more than 200% over Q1 2020. This was followed by in person and email scams. The number of scams delivered via text message, a common method for phishing scams in particular, was up 38% in Q1 compared to same time last year.

| Q1 2021 | Amount lost (millions AUD) | No. of reports | Share of money lost | Share of no. of scams |

| Social networking | $8.8 | 2,331 | 14% | 4% |

| Phone | $20.5 | 34,843 | 32% | 55% |

| Mobile Applications | $4.9 | 1,339 | 8% | 2% |

| In person | $9.4 | 448 | 15% | 1% |

| $9.3 | 9,492 | 15% | 15% | |

| Internet | $8.4 | 3,196 | 13% | 5% |

| Text message | $1.0 | 10,440 | 2% | 17% |

| $1.1 | 491 | 2% | 1% | |

| Other | $0.0 | 320 | 0% | 1% |

Proofpoint ANZ area vice-president Crispin Kerr, said:

“The latest figures from the ACCC’s Scamwatch reveals concerning insight into how cybercriminals continue to take advantage of Australians with classic tricks that are leaving them out of pocket. One of the more troubling trends we’ve observed over the last quarter is that Australians are losing more money despite an overall decrease in the total number of scams reported. This suggests cybercriminals are becoming more effective and damaging in their targeting, extracting greater sums of money from Australians with less attempts.

Investment scams which promise ‘get rich quick’ schemes are still costing Australians significant sums of money, even more so than a year ago, with men disproportionately more impacted by these types of scams than women. The recent leak of personal information from Facebook will likely lead to a further increase in phishing scams, still the most prevalent delivery method costing Australians more than $20 million in March alone. Phishing attacks are most commonly delivered by scammers impersonating legitimate institutions such as banks, online payment organisations, internet, and financial providers, in order to get individuals or organisations to divulge personal and sensitive information.

These statistics show that cybercriminals are not letting up and instead ramping up activity, utilising social engineering to play on the vulnerabilities and fears of Australian citizens. This is evident in the increase in health and medical product scams across the quarter, with March alone seeing an increase of more than 300% in money lost to these scams.

As always, we encourage Australians to exercise vigilance and common sense with all methods of communication. If you think you have received communication from a scammer, whether that’s across email, text message, over the phone, or social media, do not click on any links or share any personal information such as banking or credit card details. If you’re not sure if a communication is legitimate, contact the organisation directly. Changing passwords regularly or using a password manager are other simple steps you can take to protect your personal information from cyber criminals.”