Tesserent has released its strong half year results for Tesserent Limited and its controlled entities for the period ended 31 December 2021.

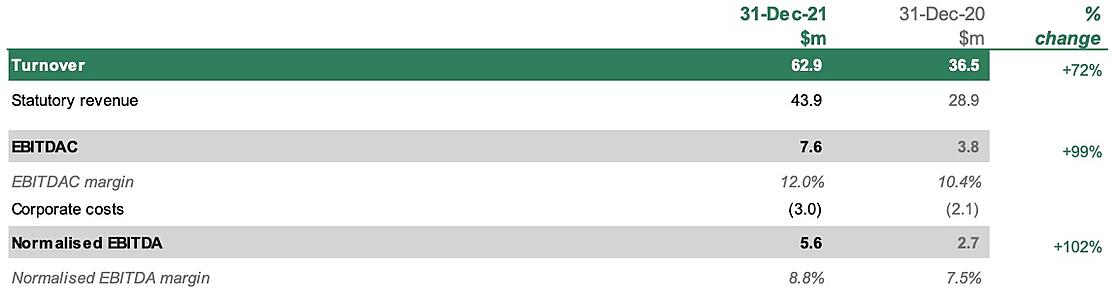

During the half-year ended 31 December 2021, the Group reported total sales turnover of $62.9m, statutory revenue of $43.9m and operational EBITDA of $4.6m. Growth in EBITDA (earnings before corporate costs) was 105% for the current quarter and 116% for H1 FY22 vs. prior year comparative period.

The first half of FY22, represented a period of continued growth of the Group and strategic consolidation of the businesses acquired in the previous two financial years. Strong growth in the underlying business was achieved in the second quarter, with year-on-year growth of 51% against the previous corresponding period. Tesserent’s annualised recurring revenue as a proportion of total annual sales has been growing strongly

“The management team has successfully executed its brand and business unit integration strategy – strengthening Tesserent’s commercial position in the market by enabling the Group to enhance its value proposition to existing and new clients and improve gross margins and net margins reported across the business,” said Mr Kurt Hansen, CEO, Tesserent.

During the half-year, Tesserent Limited also completed controlling acquisitions of three separate businesses covering both public and private sector consulting services, managed services and specialised product expertise.

As reported in Tesserent’s quarterly cash flow report, the Group’s recurring revenue as a proportion of total annual sales has been growing and is tracked as a key performance measure within the business. As at 31 December 2021, the Group’s ARR reached 44% – up from 36% at the same time last year.

“The Board and Management Team continue to focus on creating shareholder value by building on Tesserent’s position as Australia’s #1 ASX-listed cybersecurity provider. We continue to focus on our acquisition strategy to expand on our Cyber 360 capabilities, market share, fostering innovation across the Group and enhancing proprietary intellectual property to drive high-margin product and service offerings

“We are also focusing on capturing further market share in three key markets: Government (including Defence), Critical Infrastructure and Financial Services and driving growth through deeper and wider customer engagements and increasing our average number of services per customer,” explains Mr Hansen.

Tesserent Limited is integrating acquisitions into “Capability Business Units” to maximise synergy efficiencies and drive organic revenue growth through cross-selling and building out high-value recurring annuity revenue streams via Managing Security Operations (SOC) and Managed Detection and Response (MDR).