Australians reported 40,891 scams to the Australian Competition & Consumer Commission’s (ACCC) Scamwatch in August 2021, a significant increase of more than 50% compared to the previous month, and nearly double the amount reported in August 2020. Australians lost a combined $26.5 million to all types of scams last month, more than double the amount lost the same month a year ago. Australians have now lost more money to scams in the first eight months of the year than in the entire 12 months last year – $192 million year-to-date vs $175 million lost in 2020.

IDENTITY THEFT SCAMS SOAR

Identity theft scams saw Australians lose more than $2.2 million in August, a staggering increase of more than 500% over the $352,590 lost in July, and over 700% compared to the $251,750 lost in August 2020 to this type of scam. Australians aged 45 to 54 were most financially impacted by these scams, losing more than half a million dollars, followed by Australians aged 25 to 34.

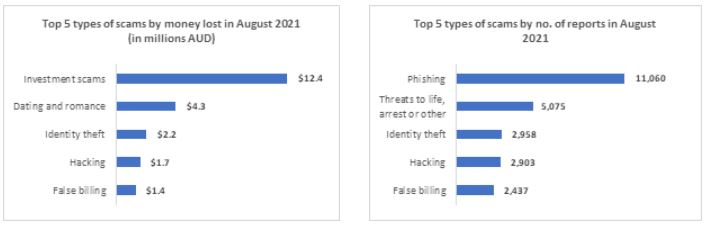

Consistent with previous months, investment scams continue to be the most financially damaging type of scam, with Australians reporting losses of more than $12.3 million. Dating and romance scams followed, amassing losses of more than $4.3 million in August. Notably, the amount lost to health and medical product scams increased by 15 times over from July as the national COVID-19 vaccine roll out continued.

Phishing scams again accounted for the greatest number of reports at 11,060, a significant increase of 162% compared to August 2020 and up 75% from July. Text messaging was the most popular delivery method for phishing scams, accounting for half of all reports. Scams relating to threats to life or arrest also rose by 29% while ransomware and malware scams were up more than 200% compared to July.

AUSTRALIANS IN LOCKDOWN HIT HARDEST

NSW residents continue to be the most financially impacted by scams as COVID-19 lockdowns continue. NSW residents suffered financial losses of almost $11 million, while the number of scams reported to the ACCC increased by 52% compared to July. Meanwhile Victorians reported a 65% spike in scams compared to the previous month and suffered losses of more than $6 million.

Men continued to be disproportionately impacted by scams across Australia, accounting for $16 million of the total money lost compared to $9 million for women, despite both reporting a similar number of scams. Men were most impacted by betting and sporting investment scams which jumped by 977% from July, accounting for 99% of all financial losses. Men were also exceedingly impacted by identity theft scams, accounting for 91% of all money lost at just over $2 million. Women accounted for 77% of money lost to online shopping scams at more than $3 million and 90% of money lost to health and medical product scams.

In August, Gen Z and millennials overtook older Australians as the nation’s most financially impacted age demographic. Australians aged 35 to 44 lost more than $7 million and reported the highest number of scams at 6,484 reports, an increase of 64% compared to July.

DELIVERY METHOD

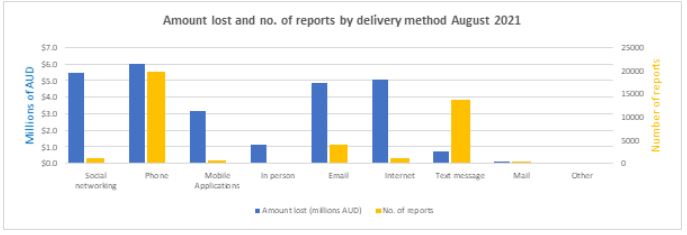

In August, phone call scams were both the most popular and profitable form of delivery, with more than 19,000 reports and $6 million lost. The number of reports for text message scams rose by more than 300% compared to July. This was likely due to the widespread prevalence of Flubot malware scams targeting Australians with fake missed call texts including a link designed to steal personal information. Social networking scams were the second most profitable, costing Australians $5.4 million, up 180% compared to August 2020. The amount lost to email scams also increased by 17% compared to July with classified scams and false billing the scams among the highest financial losses for this delivery method.

PROOFPOINT ANZ AREA VICE-PRESIDENT CRISPIN KERR, SAID:

“The latest statistics from the ACCC demonstrate how scammers are staying active and diligent in their tactics especially as many Australians remain in lockdown. In August, Australians lost a total of $26.5 million to scams, a devastating blow during what is already a very difficult time for many. Concerningly, the number of scams reported increased significantly and almost doubled compared to the same time last year. While it is good to see Australians reporting scams to the ACCC, the sheer volume of scam activity is alarming.

Scammers are continuing to capitalise on the pandemic such as the ongoing vaccine rollout. This month, the amount lost to health and medical product scams increased by 15 times over the amount lost to these type of scams in July, suggesting scammers are very much leveraging current events to steal from Australians. Understandably, many Australians are in difficult financial situations and may be looking to grow or supplement their income through investments. Investment scams remain the most profitable and common type of scam, and in August Australians lost more than $12 million to these scams. Cybercriminals can easily falsify information to make it look legitimate and lull people into a false sense of trust to get them to part with their hard-earned money.

With technology integrated into almost every aspect of our daily life, it’s important to remember that even the most tech-literate people are not immune to scams. We urge younger Australians especially, to refresh their knowledge and awareness around scams and remain diligent. We are witnessing an increase in scams targeting younger Australians with a high success rate, and during August Australians aged 35 to 44 were the most financially impacted at a cost of $7 million.

Revisiting the basics and knowing how scammers behave can help you protect yourself and loved ones. Never click-through links or open attachments from unknown senders or share personal information with anyone you don’t know, especially banking and credit card information. Don’t save your card details into websites and be wary of any new website you plan to shop from. We’ve seen the number of online shopping scams rise by 38% in August, with younger Australians especially impacted.

It’s important Australians don’t become too comfortable with technology and forget to exercise basic common sense. The current level of scam activity suggests no one is immune. We urge Australians to be careful and remember if something doesn’t look or feel right it is most likely a scam.”