By Guy Matthews, Editor of NetReporter.

There has been C-level discussion of digital transformation for several years now. Although the COVID pandemic sped up many people’s DX plans, many of those plans were already in place before the pandemic hit.

“We noted organizations doing many different things to get themselves ready for transformation, and then the pandemic was thrown upon and suddenly it was a different sort of journey,” observes Nikhil Batra, Associate Research Director with independent research firm IDC. “There was a new approach to resiliency, where you are not just addressing business challenges but learning to respond rapidly to extreme changes in the external environment.”

Digital transformation, he believes, has now evolved into digital resiliency: “Digital adaptation was the early stage where you were adopting digital technologies to help you transform – with cloud technologies, IoT, along with workplace transformation. We noted technology being a critical component here as we moved to remote work. But now comes district resiliency, helping organizations achieve the stature of a future enterprise.”

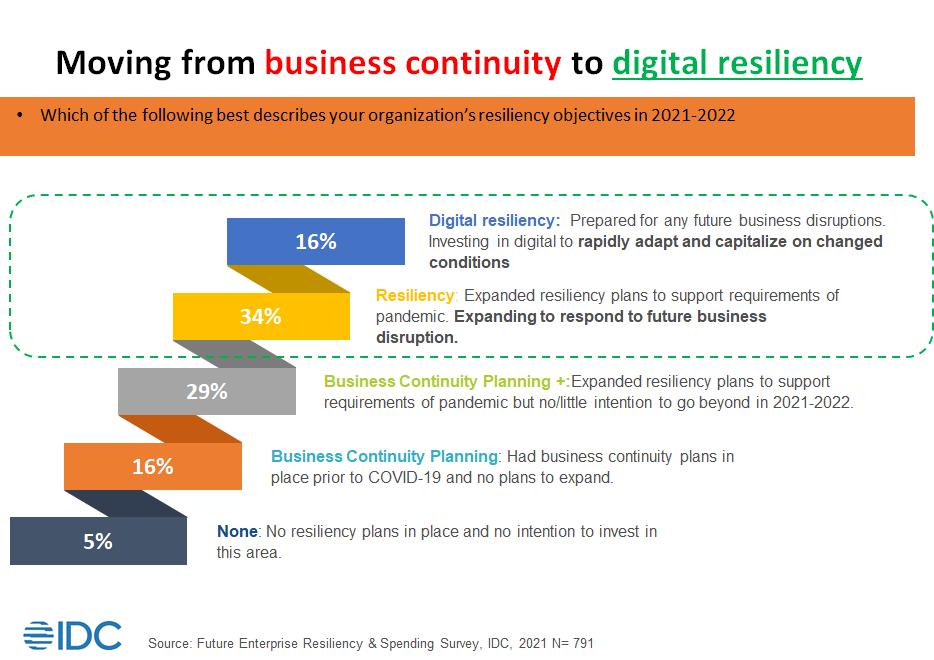

Figure 1: Moving to digital resiliency.

Talking specifically of IDC’s research in the Asia Pacific region, where he is based, Batra found there were only about 5% of organizations who had no resiliency plans in place pre-pandemic and had no intention of investing to build those capabilities. “About 16% had some basic business continuity planning, prior to COVID-19. But they did not plan to expand on that, because they felt whatever they were doing was good enough for them. About 29% of organizations felt that they needed to expand their resiliency plans and as a result, with some of them moving some workloads to cloud so that they could be accessed from outside of the company’s VPN and intranet in certain cases.”

Some, he said, never dreamed that they would go beyond the pandemic with such plans: “A band-aid kind of situation makes up about 50% of organizations,” he notes. “The remaining 50% of organizations are expanding with a future approach in mind, seeking to respond to future business disruptions which could arise and working towards addressing those challenges. Some 34% of them mentioned that they’ve started working on their resiliency plans, and 16% were even further advanced along that journey, prepared for any future business disruptions. They treated this pandemic as not just a challenge but also as an opportunity to leapfrog some of their competition.”

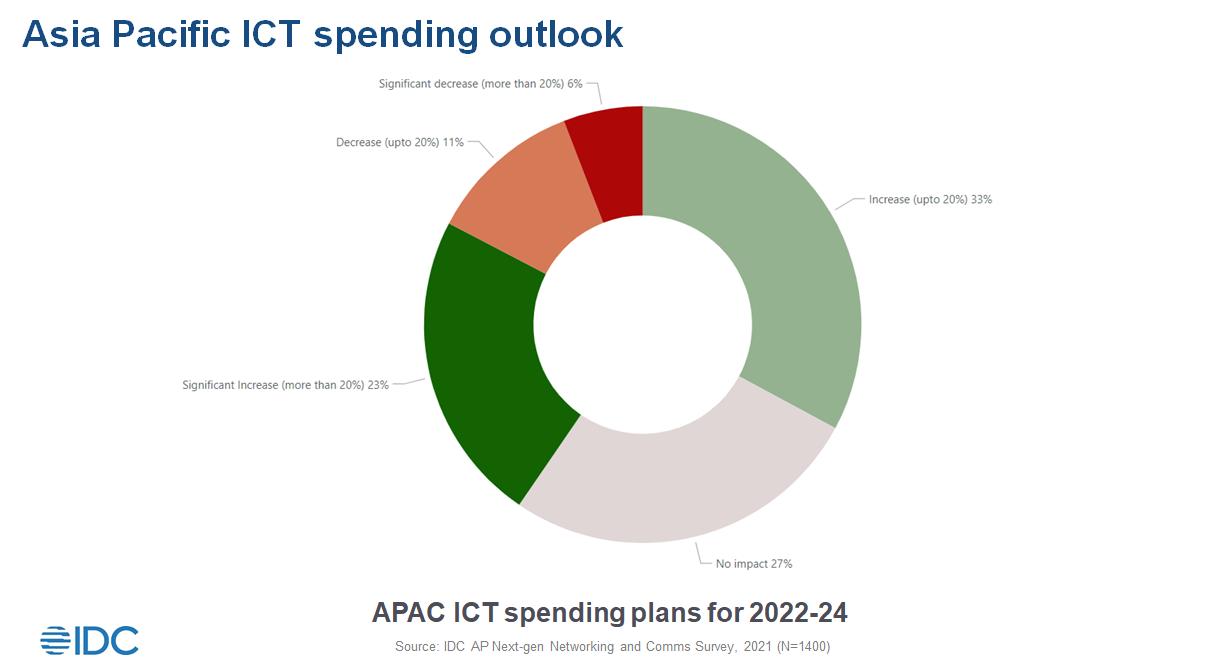

Figure 2: Asia Pacific ICT spending.

Among the findings recorded by IDC over the last couple of years is that almost 80% of organizations across Asia Pacific say revenues have been significantly impacted: “But only about 17% of organizations said that their ICT spend has declined,” observes Batra. “A really large percentage of organizations, about 53%, said that they’re spending more versus pre pandemic. So what does that mean? A lot more organizations are looking at this not just as a challenge that they have to get through but they’re looking at an opportunity to get ahead.”

To broaden the conversation, Batra involves an expert panel with direct experience of implementing transformation in the face of crisis. Rajasegaran Subramaniam is Assistant Director for Global Delivery APAC with food and agriculture giant Cargill, based in Singapore.

“A lot of our digital transformation started four to five years ago,” he says. “With the pandemic we are just speeding up some of the things that we already thought about. Our customers are also changing how they’re engaging with us.”

He breaks future planning into three main areas: “One is to digitize our supply chain. We have a program to implement smart manufacturing, and use the data to make sure that we can maximize production yield and make sure that we optimize power and water consumption. How can we use the digital twins when we change some of the parameters in the production line? We also look at the intelligent supply chain, at where food is coming from. For example, using blockchain to make sure that the chocolate that we are eating is coming from the right farm, and that we can take care of the welfare of the people so production is sustainable in the long term.”

He says Cargill is also focussed on transforming its approach to the customers and the market: “We are not just selling a traditional agriculture product, we are also getting into digital service and how we use technology to engage our customers. We are creating digital products, and mobile apps to provide information to farmers in various parts of India. We try to cut the middle people out so that we can give much better prices to those farmers.”

Cargill’s third transformational push is ERP modernization: “For non-ERP systems, we try to modernize by moving it into the cloud,” claims Subramaniam. “We are already in the last phase of deploying a software-defined, wide area network as well as focusing on cybersecurity.”

In the opinion of Raman Mehta, SVP & Chief Information Officer with electro-mechanical manufacturer Johnson Electric, digital resiliency is becoming a CEO-level discussion. “We grew out of automotive,” he says. “We are a tier one or tier two supplier, to automotive OEMs throughout the world. We have 35,000 employees in 23 countries and deal with the whole automotive supply chain, as manufacturing for markets like home automation and robotics.”

He agrees that when it is time to leapfrog the competition, this can only happen at speed with the right digital platform: “The ERP journey takes time, and we had a lot of fragmented systems,” he explains. “We needed to connect these systems and take people out of their comfort zones. Because otherwise you’re looking at a long modernization roadmap. But if I bring in innovative business intelligence solutions, that can really speed things up. Things that used to take weeks now we can do in minutes. We can look at our demand patterns and find out which are the long lead item semiconductors by connecting the ERP system in the cloud. People are getting more empowered and making decisions based on data. Before they would spend 80% of their time going through spreadsheets, PowerPoints, emails. We want to turn that on its head so you spend less than 20% of your time collecting information, and over 80% analysing it.”

Thiagaraja Manikandan is President & Group CIO at Olam International, a $30 billion company active in around 60 countries in the agricultural and food space. He says Olam’s digitization journey started back in 2016: “It wasn’t a pandemic response, because we recognized early that digitalization was the only way to go,” he explains. “Digitalization has the ability not only to transform your internal business operations and business model, it can transcend beyond those boundaries to transform an entire ecosystem.”

Olam has launched several digital platforms, starting with one for assessing a farmer’s land for traceability and sustainability, looking at fertilizers and carbon footprints. Another platform was about providing services for farmers with a poor livelihood. In India alone, there are over six million farmers on that platform. A digital warehousing platform and smart factory initiative followed: “We can visualise factories as a digital twin, as well as view millions of hectares of land with a combination of smartphones, drones, image analytics and IoT devices,” he notes.

Adding to the depth of the discussion is Amitabh Sarkar, Vice President & Head of Asia Pacific with TATA Communications, an enabler of the sort of transformation the others are mapping out. He says TATA’s reach covers extreme automation, digital resilience and hyper-connected ecosystems embedded with strong AI, ML and deep data analytics.

“If I look at TATA Communications, the question during pandemic was, how do we enable our employees to collaborate using tools and technologies to deliver a seamless experience to our customers in the hybrid world. This at a time when 98% of our employees were working from home in geographically dispersed locations – a huge challenge. But I think the result was stronger customer centricity through formation of customer success teams. There was an added sharpness as the focus shifted to digital platforms and solutions, bringing efficiencies globally through automation and with the right operating model.”

Sarkar says that TATA’s future aim is to continue on its own transformation journey and also play a solid role as a digital ecosystem enabler: “We will be building a digital fabric on which our customers, regardless of industry can build secure, connected, digital experiences. We see huge opportunities and driving growth in Asia Pacific is a top priority.”

Cargill’s Subramaniam acknowledges that efforts to create a software-defined wide area network owe a lot to Tata Communications as a key part of that journey: “We have been working together with TATA for past two years now, and have completed about 200 sites across Asia,” he notes. “Cyber security continues to become another investment area. But most important is smart manufacturing.”

Mehta of Johnson Electric agrees that networks are the lifeline of any company: “The MPLS networks of the old days with their fixed costs are not going to cut it in the modern workplace,” he concludes. “The Internet is becoming the corporate network. Now with built-in resiliency and multipath selections, you can dynamically select which application you put into which cloud, all driven by machine learning and optimized traffic routing.”