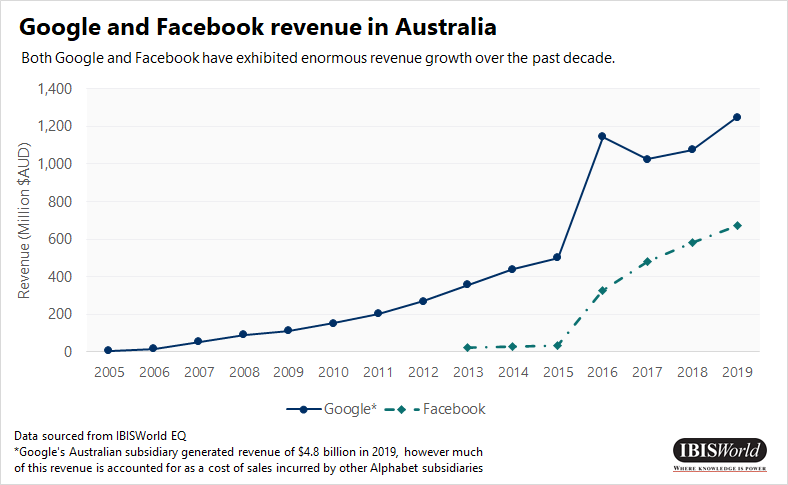

Technology giants Google and Facebook face a looming confrontation with the Australian Government this week, following the end of consultations on the contentious News Media Bargaining Code tomorrow (28 August 2020). This world-leading regulation would force these multinational corporations to pay for the right to include Australian journalism content in Google Search and Facebook News Feed.

‘The costs associated with this Australian regulation would likely only have a minor impact on the profitability of these tech giants. However, the true consequence of this regulation lies in the precedent it could set at a time when the power of technology corporations is coming under greater scrutiny in the United States and the European Union’, said IBISWorld Senior Industry Analyst Jason Aravanis.

To avoid the risk of this precedent, reports have indicated a serious possibility that Google could withdraw from Australia entirely, rather than comply with the regulation in its current form. This decision would remove access to common technology services including Google Search, Google Maps and YouTube. This profound response to Australia’s proposed new code has precedent. In 2014, Google completely shut down its Google News service in Spain, after being subject to licensing regulations in that country.

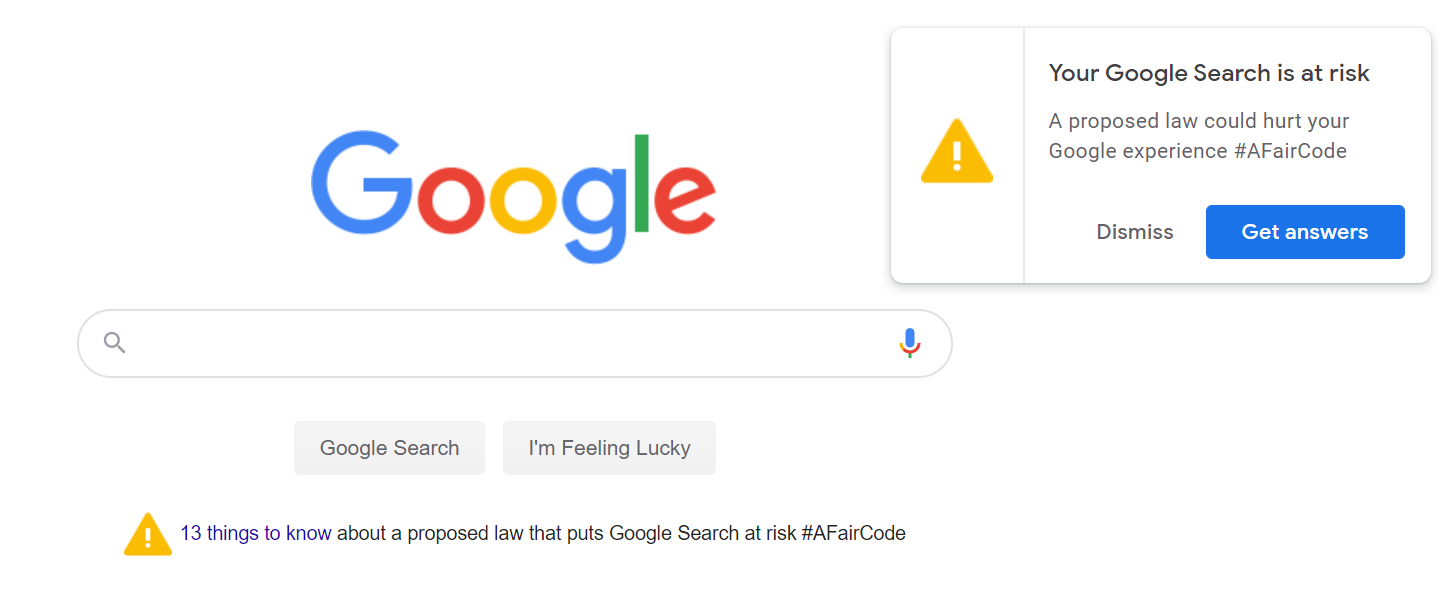

Google escalated its confrontation with the Federal Government this week, by placing the warning below on its Google Search results and the popular Google Chrome internet browser. The extent to which the public will engage in this issue, and which side they will support, is unclear.

Why new regulation now?

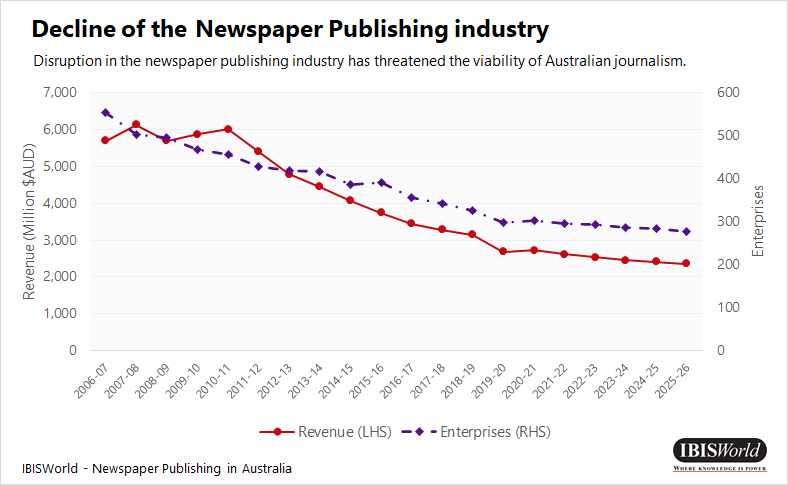

A draft News Media Bargaining Code was released in July 2020, following a multi-year investigation by the ACCC into the market power of Google and Facebook. The preservation of the Australian media landscape, which has been eroded by technological change over the past decade, is a key focus of the new regulation.

‘Revenue in the Newspaper Publishing industry has declined from $5.9 billion in 2009-10, to $2.7 billion in 2019-20, representing an annualised decline of 7.5% each year. Employment in the industry has fallen by 55.6% over this period, particularly due to the closure of small-scale and regional publications’, said Mr Aravanis.

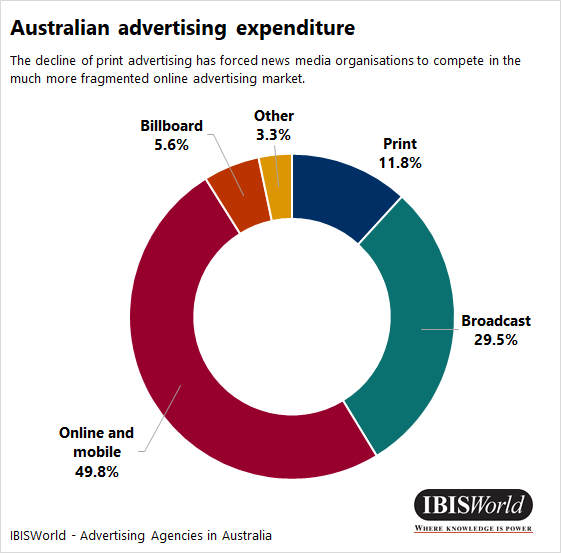

This loss is attributable to two primary factors. The first is the falling value of print advertisements amid the transition to online media consumption. The second is the falling value of news medias’ digital advertisements. Media organisations have been forced to offer digital advertisement services at a low price point to remain viable against alternative providers, including Google through ads placed in search results and Facebook through ads embedded in user newsfeeds.

However, the relationship between Google, Facebook and Australian media organisations is multi-faceted. In addition to being competitors in the Online Advertising industry, both companies are also essential business partners. Both Google and Facebook rely heavily on the inclusion of journalism content in their platforms in order to drive consumer traffic. According to the ACCC, between 8% and 14% of Google Search results trigger a ‘Top Stories’ result, which typically includes content from news media websites. A 2019 study from the University of Canberra found 33% of Australian consumers access news through social media, and 25% access news through search engines.

‘It is clear that both digital platforms derive value from the inclusion of media content. However, media providers have little ability to make digital platforms pay for access to this content,’ said Mr Aravanis.

A news media business risks losing a significant source of revenue if it prevents Google from providing links to its websites in search results. In Germany, Google negotiated individual licensing agreements with media publishers. Media organisations that failed to secure an agreement saw a significant decrease in traffic to their websites once their results were removed from Google Search results. Due to this outcome, many German media organisations agreed to let Google access their content for free. This imbalance in negotiating power has led the Federal Government to introduce a negotiate-arbitrate framework through the News Media Bargaining Code.

Google and Facebook have argued that news media organisations already receive fair compensation for their content, through the direction of consumers to news websites via results in Google Search and the Facebook News Feed. Facebook has said it sent 2.3 billion clicks to Australian news publishers in the five months from January to May 2020, which they estimated to be worth $195.8 million to the news organisations.

The negotiate-arbitrate model

The regulatory model proposed by the ACCC to force Google and Facebook to agree to terms with Australian media organisations is similar to the one used to break up Telstra’s former monopoly on the Telecommunications Services industry prior to 2005-06, when it owned the country’s entire copper phone network.

‘Under this model, if the two parties are unable to reach an agreement the process will automatically move to a binding final offer stage. Each party will propose an agreement, and an independent arbitrator will pick one agreement. Final offer rules are designed to avoid easily ruled out claims, and force the parties to converge or risk the opposing party’s position being accepted by the arbitrator,’ said Mr Aravanis.

The worst case scenario

If a satisfactory resolution cannot be found, Google has indicated a willingness to ‘go dark’ on its popular and ubiquitous services, in order to dissuade other nations from following Australia’s regulatory example. Google Australia generated $4.8 billion in revenue in 2019, up from $4.2 billion in 2018. This result represents close to 2% of the global revenue of Alphabet Inc, Google’s parent company. How Google’s withdrawal from Australia would work in practice is unclear, but it would certainly threaten a range of industries that rely on Google’s services. According to Alphabet Inc, the services provided by the search engine supported 116,200 Australian jobs in 2019, including 79,200 jobs for small and medium enterprises.

Facebook has argued that if no news content was available on Facebook in Australia, the impact on Facebook’s community metrics and revenue in Australia would not be significant. It is unclear what Facebook’s response would be if the regulatory code was legislated in its current form.

The confrontation between the technology giants and the Federal Government is expected to come to a critical point in the near future. The consultation period on the News Media Bargaining Code is set to expire at the end of this week. Following that, both consumers and businesses will have to watch and wait to see how this issue is settled. The ramifications for the internet and the Australian businesses that rely upon Facebook and Google are uncertain.