Australians lost more than $34 million to all types of scams in January 2022 according to the latest figures from the Australian Competition and Consumer Commission’s (ACCC) Scamwatch.

This figure is up more than 50% compared to the start of 2021, but down from the $43 million in losses reported in December 2021, which was a record month for losses in 2021.

There were 21,110 scams reported to the ACCC in January, an increase of 45% from the previous month.

Source: Proofpoint, Scamwatch

Adrian Covich, Senior Director at Proofpoint, commented: “While it is promising to see a decline in the amount lost to scams compared to the end 2021, looking at the statistics from the same period last year highlights just how successful scammers have become at stealing from hard-working Australians. Last year was a record-breaking year for scams with more than $323 million in losses and 286,000 reports according to Scamwatch. With scammers and cybercriminals continuously reinventing their tactics and finding new ways to exploit Australians for financial gain, there is every chance we will see these statistics continue to rise this year.”

Top Scams in January 2022

Investment scams were the most financially damaging type of scam in January costing Australians $21 million, more than double the amount lost in the same month last year. This figure was consistent with 2021 where investment scams were the biggest single source of money lost throughout the year, costing Australians more than $177 million.

Dating and romance scams were the second highest in terms of money lost, amounting to $5.2 million. Australians aged 65 and over accounted for the greatest losses to these scams at $2.3 million, with residents in Western Australia accounting for almost 40% of total losses.

The amount lost to hacking scams increased significantly, more than doubling from December. The amount lost to scams relating to threats to life or arrest increased by nearly 300% month-on-month, with younger Australians aged 18-24 suffering 35% of all losses. Losses from betting and sports investment scams increased by nearly five times in January with women accounting for 75% of these losses. With the arrival of New Year shopping sales, losses to online shopping scams increased by 36% from December, while losses to jobs and employment scams rose by almost a quarter.

As for the number of reports, phishing scams were the most common in January 2022 with 6,751 reports, up more than 50% from the previous month. Phishing scams were overwhelmingly carried out via text message, with 61% of all reports delivered via this method.

Online shopping scams rose by 32% from December to become the second most reported scam in the month, with 37% of all reports resulting in a loss. Scams attempting to steal personal information including hacking and identify theft increased from December by 48% and 33% respectively, with Australians aged over 65 reporting more of these scams than any other age group. Ransomware and malware scams also rose significantly in January, with reports increasing by 87% compared to December and nearly three times higher than the same time a year ago.

Source: Proofpoint, Scamwatch

Age and Location

Australians aged over 65 reported the greatest losses to scams in January totalling $8.6 million, down nearly 50% compared to December. Australians aged over 65 accounted for the most reports of scams in January at 24%, however compared to all other age groups represented the smallest monthly increase.

The amount lost by Australians aged 35-44 more than doubled in January to $7.9 million, the highest on Scamwatch’s record for this age group, while losses also increased by 24% for Australians aged 25-34. Younger Australians aged 18-24 accounted for the greatest increase in the number of reports, rising by 56% in January. Reports by Australians under the age of 18 also increased by almost 50% compared to December.

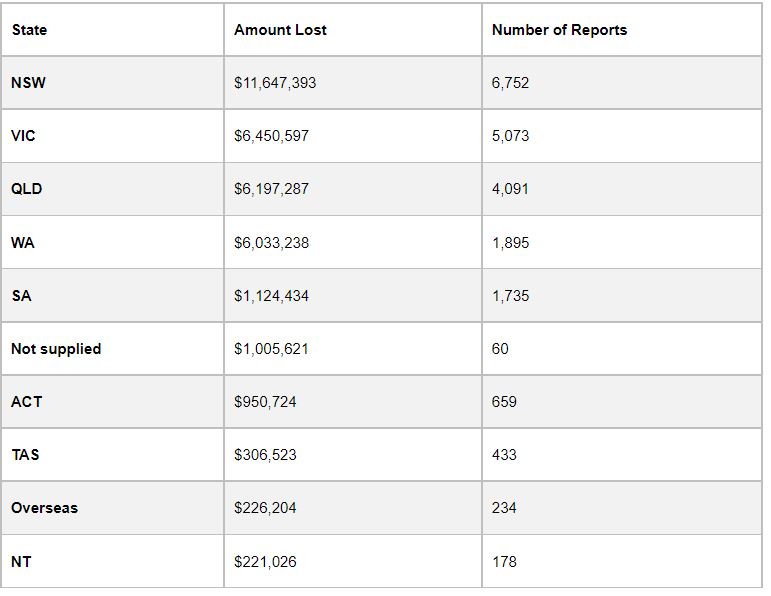

Across January, women lost more money to scams totalling $18.1 million, up 27% from December, compared to $15.8 million lost by men. West Australians lost a record $6 million in January, the highest amount for the state to-date and more than three times higher than losses reported in December. The amount lost by Tasmanians also more than doubled in January and increased by 92% for Australians in the ACT.

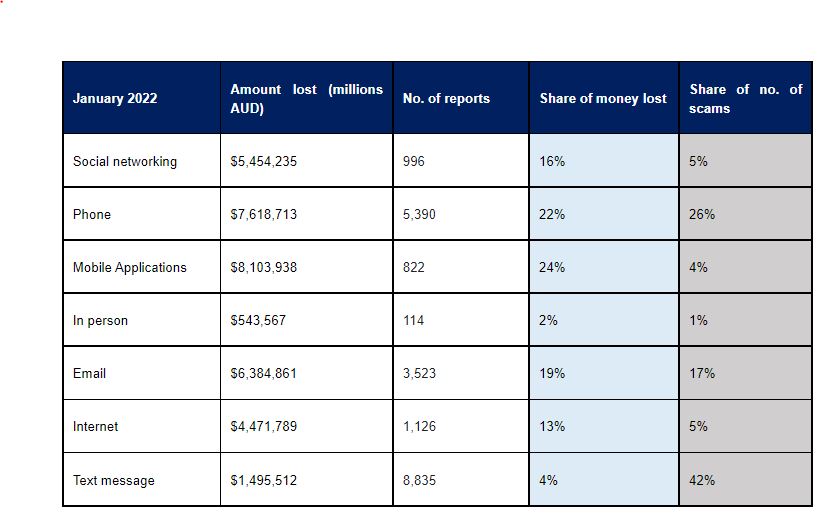

Delivery method

Text message scams overtook phone scams as the most popular delivery method in January, with 8,835 reports, more than double compared to the same time last year. Phone scams remained high with 5,390 reports, up 25% from December. The number of internet and email scams also increased in January by 24% and 16% respectively.

For the first time on Scamwatch’s record, mobile apps were the greatest source of money loss accounting for $8 million of total losses, up from $3 million in December and more than four times higher than the same period a year ago. A large majority of the losses from mobile app scams came from investment and dating and romance scams totalling $5.5 million and $1.9 million respectively. Phone scams resulted in $7.6 million in losses, followed by email scams at $6.3 million, an increase of 43% compared to January 2021. The amount lost to text message scams increased by nearly 400% compared to the same period a year ago.

Source: Proofpoint, Scamwatch

“With the latest figures from the ACCC suggesting scammers are showing no signs of slowing down in 2022, ensuring Australians stay vigilant and do everything they can to protect themselves from falling victim to scams is crucial. The new year is a good time for Australians to refresh their knowledge of how to spot a scam and make sure they are doing everything they can like updating passwords to prevent scammers from stealing their personal information.

“January showed us that investment scams continue to be a very effective method for stealing Australian’s hard-earned money. Older Australians are unfortunately overrepresented when it comes to losses to investment scams, often falsely promising quick and high returns by investing their retirement savings. But we know this is often not the case, resulting in significant financial damage.

“Our advice for people both in their personal lives and the workplace is to always err on the side of caution when they receive communication be it a text message, email or phone call from someone they do not know. Scammers are on the hunt to steal personal information using false billing and hacking scams to lure sensitive information from people. Mobile apps and text messages in particular are becoming increasingly popular channels used to target Australians, while more traditional methods like email remain a challenge particularly for organisations with a remote or hybrid workforce.

“In 2021 we saw how scammers leveraged the pandemic and lockdowns to inflict extensive financial harm. We anticipate scammers will continue to use these kinds of events and proven tactics as well as trial new ways to scam Australians out of personal information and money. As always, we urge Australians to remain vigilant. Anything that looks or sounds too good to be true most usually is,” concluded Mr Covich.

Appendix

Amount lost and number of reports January 2021 – January 2022.

Amount lost and number of reports by state – January 2022.

Amount lost and number of reports by age group – January 2022.